Accept

I am dead, who cares about my digital death and digital estate? What is the worst that can happen?

You have spent your life providing and protecting your loved ones, and now you must also account for your digital life.

The world has gone digital. In 2019, there were an estimated 4.4 billion active internet users. With the upcoming emergence of 5G wireless technology, Ericson projects that over 65% of the world population will have access to the internet (Taylor C., 2019). Whether people realize it or not, they are creating a digital footprint, both intentionally and unintentionally. This is where Final Security's digital estate planning and end-of-life services become so important: 1) to protect you and your loved ones from identity theft by erasing your devices, 2) to organize and efficiently transfer your digital estate (documents, files, photos) to your family, and 3) to delete your social media accounts.

I am dead, who cares, what is the worst that can happen?

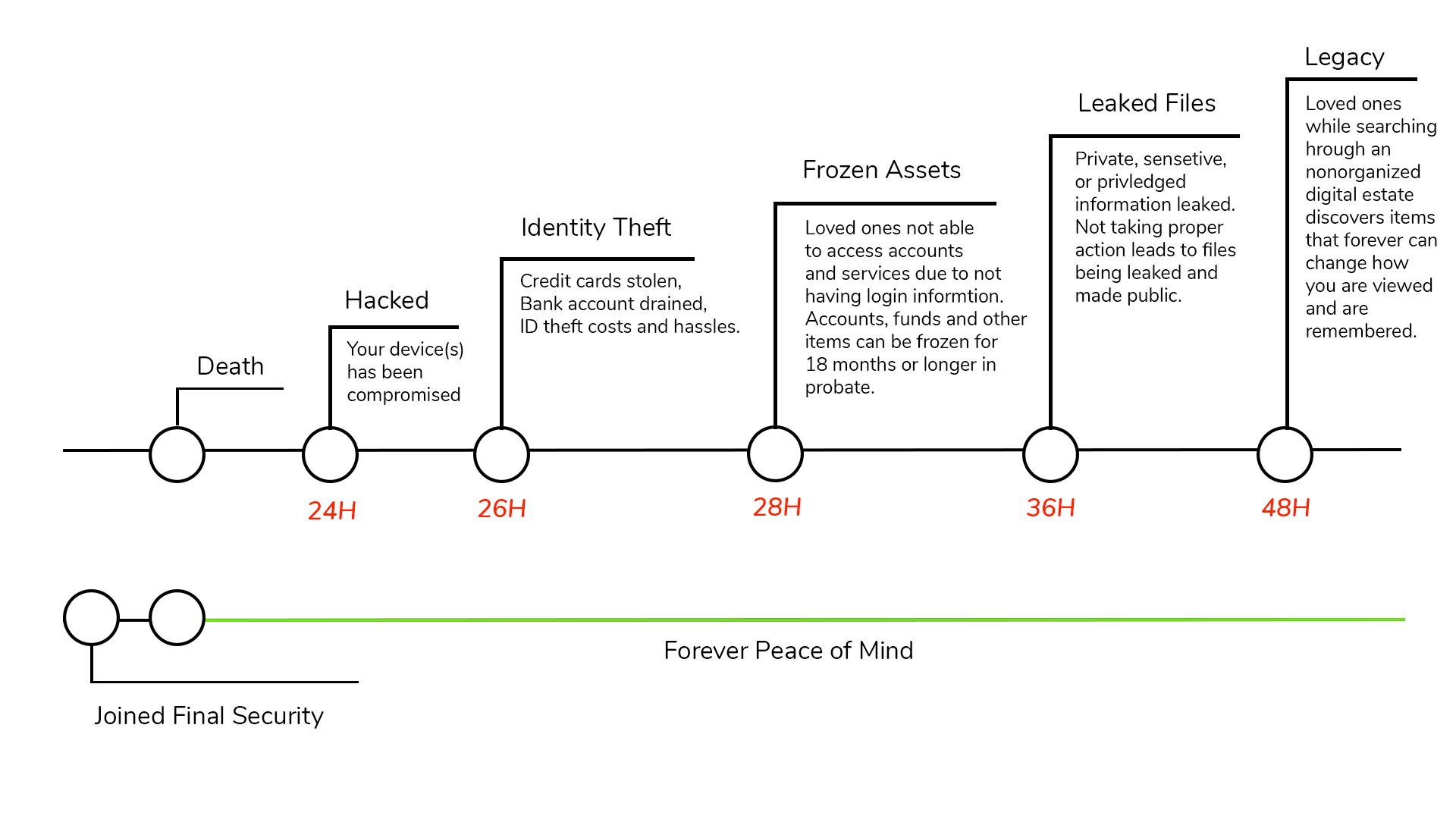

In 48 hours, your unaccounted for digital footprint can cause your loved ones tremendous burden, stress and expense, all while leaving your entire life and legacy forever tarnished.

Protection from Identity Theft

According to AARP, it can take six months for financial institutions, credit-reporting bureaus and the Social Security Administration to receive, share or register death records. Widely available funeral announcements create the perfect scenario for criminals to strike, your digital estate a prime target for identity theft and other types of financial and digital theft. It has become imperative that you start to plan properly for your digital death.

Did you know that according to AARP, close to 800,000 deceased individuals are targeted for identity theft annually? That's almost 2,200 a day. With a name, address and birth date, criminals can purchase a Social Security number for as little as $10. Stealing the identity of the deceased is called ghosting, and you can learn more about it here.

Take a moment and think about all the financial, personal, sensitive or private information that you may have on your devices:

- Credit cards

- Tax documents

- Social Security numbers (for all family members, likely including yours)

- Medical records (for all family members, likely including yours)

- Banking information

- Retirement information

- Investment information

- Private conversations

- Private and personal data

- Private location data

Cybercrime has become more profitable than the drug trade

Cybercrime has become more profitable than the drug trade (Fortune, 2020). Within 24 hours of death, your device(s) can be hacked leading to identity theft, your bank and financial accounts being drained and stolen credit card numbers.

Organize Your Digital Estate now, or your digital and offline life could be frozen for 18 months or more in probate

If you have ever lost a loved one, you may have gone through the process of estate planning or settling their estate.

Estate planning can make things easier for your loved ones after you pass. You can think out how you would like each part of your life settled - accounts and debts, property, funeral arrangements, etc. Your digital property is no different.

As technology has become a main component to most aspects of our lives, we are constantly building a digital footprint. Consider all the different aspects of your daily digital life:

- Email accounts

- Social media accounts

- Important documents

- Photos

- Music

- Spreadsheets

- Medical files

- Cryptocurrency files

- Subscription information

- Financial information

- Investments

- Digital projects

- Family Recipes

Each different area has different rules, processes and requirements for your loved one to be able to access (if even possible) your accounts when you are gone. Your assets, including money, could be frozen for 18 months or longer while you are going through the probate process. Not only is this incredibly frustrating for your loved ones during this difficult time, they will also incur significant expense via the court and lawyers. Setting up your File Vault today can ensure your loved ones do not have additional hassles and expenses.

You have a responsibility to make sure your work files are securely transferred and cleaned

Do you have work items on your machine that could contain private or sensitive information? Some examples include: Student records, human subject research, client privileged information, research data, public budget data, employee data. It is your responsibility to make sure this information is passed to the appropriate people to ensure the continuation of the work, but also to ensure that it does not get leaked. Only you know the scope of damage that could be possible to those that are affected by your work.

Do you care how your loved ones will remember you?

Do you have items stored that you would not want others to see? Some examples include: private conversations, location data, private notes, adult content. While you may know about certain items on your devices, you could unknowingly have information that, without context, could be perceived in the wrong light. Miscommunication is always the start to misunderstandings, and in this case, your image could forever be tarnished.

How at risk is your digital estate?

Digital estate planning, like traditional estate planning, is about making sure your loved ones are taken care of and protected. You have spent your life providing and protecting your loved ones, and now you must also account for your digital life.

Our Digital Estate Risk Assessment Calculator will help you understand your risks and how to properly handle them. You can find that here.

How can I protect myself?

Plan for your digital death, and protect you and those you love!

Now that you are aware of the risks of not cleaning and organizing your digital end-of-life, getting protected is quick and easy.

Identity Theft

To protect yourself from identity theft, you will use the combination of device wiping and our file vault. You will store your important files in your secure vault for your designated beneficiary. Registering your device with our wiping service will ensure your data has been securely wiped clean.

Your Digital Estate

There are three main areas to address with your digital estate: 1) devices, 2) files and 3) social media. To properly secure your digital estate across these three areas: 1) protect your devices by registering them for remote wiping, 2) upload your important files and photos to your secure file vault and 3) register your social media accounts to be deleted.

Your Legacy

Protecting your legacy can be difficult. You could have items that you do not even realize on your devices. The best course of action is to register your devices with our wiping service to ensure your data has been securely wiped clean.

Your Work

To ensure your privileged, patient, private or research data is not leaked or made public: 1) register your devices for remote wiping, 2) upload important documents to your file vault to be sent to a designated beneficiary.

Taylor, C. (2019). 5G coverage will span two thirds of the global population in 6 years, Ericsson predicts. CNBC. From: https://www.cnbc.com/2019/11/25/5g-will-span-two-thirds-of-global-population-in-6-years-ericsson-says.html

How cyber attacks became more profitable than the drug trade. (2020). Fortune. From: https://fortune.com/2015/05/01/how-cyber-attacks-became-more-profitable-than-the-drug-trade/

Digital Estate Risk Assessment Calculator

According to AARP, it can take six months for financial institutions, credit-reporting bureaus and the Social Security Administration to receive, share or register death records. When you consider that timeframe and that cybercrime is now more profitable than the global illegal drug trade, your digital estate is the perfect target for criminals. We need to protect and organize our digital lives in preparation of our digital death.

How at Risk...

Is Your Digital Estate?

Get your free personalized digital estate planning report in just a few minutes.

Start Your Free Assessment

BANK-GRADE SECURITY

Your privacy, safety and security is our top priority and at the core of everything we do. Your data is encrypted and protected at every level. From typing on your computer, through the Internet and into our application and servers.

Learn more about how we secure your data.